E-101 form – How did no one think of this before?

Every employee knows the complicated procedure of an annual 101 Form right in at the beginning of his employment and every year on January 1st. In this form, submitted to the IRS, the employee fills his personal details and his annual income it is the employees duty to report the change in his personal details.

According to tax regulation from 1993, the tax calculation became the employers duty and therefore he should get the employee details from a 101 form. In most companies this process is done manually and time-consuming to the payroll managers.

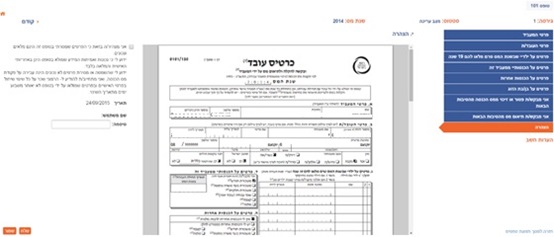

In order to improve the form data collection processes in front of the organizations, the Tax Authority updated the requirements and now allows the employer to edit and save an electronic 101 form, which in most cases will have interface with attendance management system and employees payroll.

E-101 form is easy and friendly solution for everyone involved in the process of data collection and reporting. All the employer should do is submit a statement in the local tax office and prior to commencement of the year in which the employer wants to start the process this mail and timely.

Synel Mll PayWay LTD is the leading company in the field of pension clearing, issuing payroll and employee attendance management organization. Synel developed a unique solution to fill in the 101 electronic form through HARMONY salary software.

E-101 Form by Synel authorized by the Israel Tax Authority. Employers will save valuable time and will stop the waste of paper and unnecessary filings. In addition, the employer will enjoy fast and easy access through a dedicated online portal.

Synel’s e-101 is friendly, convenient and efficient solution. And the question arises: how no one thought of this before?!

+44 208 900 9991

+44 208 900 9991 +01 480-374-7770

+01 480-374-7770